Whenever I hear “Brown Eyed Girl” I’m instantly back in Richmond, Virginia. It’s 1968, and I’m at a bar mitzvah in the JCC Activity Room, dancing with a boy for the very first time. There’s a visceral response – excitement, happiness, plans for our upcoming wedding …

My point is, when you hear music, especially music from a critical point in your past, it evokes powerful emotions and memories – more powerful than you might think. In fact, what we may only see as a familiar song from our early teens and adulthood could in fact be a bridge back to connection for patients with Alzheimer’s disease and dementia.

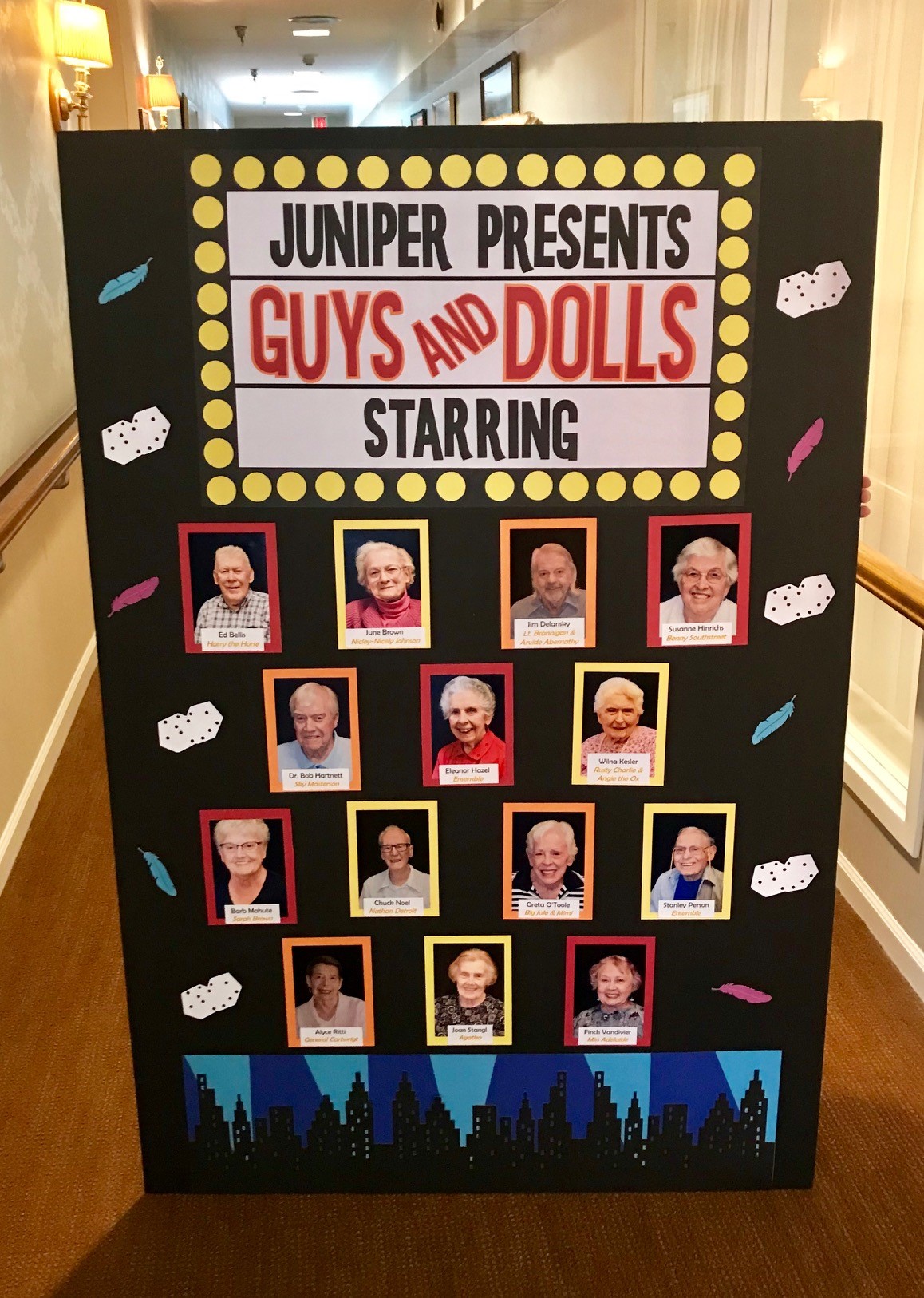

Guys and Dolls are Singing in the Rain at Juniper Senior Living Communities

A few months ago, I reached out to Katie Kensinger, Social Media, Sales, and Marketing Director at Juniper Senior Living Communities in State College, PA. Through Music Theater International’s (MTI) “Broadway Senior” pilot program, Katie and the Juniper team have produced five musicals at Juniper communities, including popular titles such as “Singin’ in the Rain, Senior” and “Guys and Dolls, Senior.”

“It’s transformative – an opportunity to celebrate who they are now, to have fun, and to show what they’re capable of,” Kensinger says. Performing in front of small audiences of other residents, the actors, whose average age was 87, “saw themselves differently.”

For some, it was not just an opportunity to see themselves differently, but to see themselves again.

If you were to attend a Broadway Senior production, you would not be able to tell which actors were living with dementia.

KATIE KENSINGER, SOCIAL MEDIA, SALES, AND MARKETING DIRECTOR AT JUNIPER SENIOR LIVING COMMUNITIES

“Residents who participated in the Broadway Senior program became more engaged overall in community life, and this engagement continued even after the program ended. This was true for those residing in assisted living (personal care), skilled nursing, and memory care.”

In fact, she added, those residents in memory care, “have been full participants in the Broadway Senior program. Some have played leading roles, while others have acted in supporting roles or have sung in the ensemble. If you were to attend a Broadway Senior production, you would not be able to tell which actors were living with dementia.”

MUSIC & MEMORY® Personalized Playlist Program Improves Quality of Life for Patients with Dementia

MUSIC & MEMORY®, another program that Juniper uses in its memory care communities, helps individuals with a wide range of cognitive and physical conditions to “engage with the world, ease pain, and reclaim their humanity” through the use of personalized music playlists.

“People living with dementia or some type of cognitive or physical limitation can experience significant stress and anxiety” says Justin Russo, MUSIC & MEMORY® Program Director. “Offering them a playlist of their favorite music can help to focus their attention on something that’s recognizable, which reduces the feeling of being overwhelmed and confused. They’re better able to understand what’s happening, and they’re better able to relate to their caregiver because it’s a comfortable place for them.

“MUSIC & MEMORY® trains healthcare and community professionals to create favorite music playlists for the people they support.” Russo says. “We encourage staff to work one-to-one with participants to discover their musical preferences, favorite pieces and performing artists, with the goal of creating a 10-25 song playlist. For people who have trouble communicating, staff are advised to observe body language and find out as much as they can from other sources, particularly family and friends, about the individual’s background, which takes time but is extremely rewarding. (Download a copy of MUSIC & MEMORY®’s “How To Create A Personalized Playlist for a Loved One at Home” here.)

“While the music gives them joy in the moment, there’s also a carryover effect right after the music session, sometimes as long as 30-45 minutes, where the participant has more access to themselves, allowing them to converse, socialize and be more present for family visits and medical appointments.”

Personalized music therapy can also reduce the use of psychoactive drugs. In a 3-year study published in the Journal for Post-acute and Long-term Care Medicine (JAMDA) researchers from the Betty Irene Moore School of Nursing at UC Davis found that personalized music is associated with a reduction in the amount of antipsychotic medication taken by nursing home residents and fewer distressed behaviors.

“There is Still a Self to Be Called Upon … and Only Music Can Do the Calling”

“Nothing activates the brain so extensively as music,” said Dr. Oliver Sacks, former professor of Neurology at Columbia University and author of the book, Musicophilia. “Once one has seen such responses, one knows that there is still a self to be called upon, even if music, and only music, can do the calling.”

“Music can lift us out of depression or move us to tears – it is a remedy, a tonic, orange juice for the ear. But for many of my neurological patients, music is even more – it can provide access, even when no medication can, to movement, to speech, to life. For them, music is not a luxury, but a necessity.”

Oliver Sacks, M.D.

Music can trigger whole regions to communicate, according to a release in Science Daily. “By listening to the personal soundtrack, the visual network, the salience network, the executive network, and the cerebellar and corticocerebellar network pairs all showed significantly higher functionality and connectivity. … Language and visual memory pathways are damaged early as the disease progresses, but personalized music programs can activate the brain, especially for patients who are losing contact with their environment.”

“Like Having Her Dad Back Again”

Both Kensinger and Russo have witnessed remarkable results with both the “Broadway Senior” and the MUSIC & MEMORY® programs. “Anecdotally,” Kensinger said, “associates in our memory care buildings observed that the “Broadway Senior” actors demonstrated improved word finding and were generally more social while they were participating in the program. In one of our productions, the actor cast in the leading role had a dementia diagnosis. Over the years he had been very involved with the local community theatre but hadn’t performed in quite some time. When he performed in Broadway Senior, his daughter shared with us that it was like having her dad “back” again – he came to life onstage, was vibrant and joking.”

When he performed in Broadway Senior, his daughter shared with us that it was like having her dad “back” again.

Katie Kensinger

“The therapeutic benefits of music are well-documented, and the effects of music can be quite dramatic. Quite simply, music enhances our quality of life in a way that is restorative of identity and connection to others. And this is true for people with dementia. At present, there is no cure for dementia. And so our goal for the person we are caring for cannot be a cure. Instead, as with any terminal illness, we strive to do everything we can to help them have as much comfort, as much pleasure, as much meaning, as much wellbeing in their days as possible.

“People with dementia are really no different than the rest of us,” Russo added, “They may have fewer options, but the goals are the same.”

Notes:

Dementia is an umbrella term to describe the disorder that results from brain disease or injury marked by memory loss and loss of cognitive abilities. Alzheimer’s disease is the most common cause of dementia, accounting for 60-80% of cases.

Alive Inside is available for rent or purchase and can be viewed on Amazon Prime and other streaming sites

According to Drew H. Cohen, President & CEO of Music Theatre International, the organization is currently conducting further studies to better understand the specific needs of senior living communities before finalizing “Broadway Senior” musical materials and making them available for licensing.

The MUSIC & MEMORY® program was started in 2016.

I did not marry the boy at the JCC. I found someone much better and the first song we danced to was Layla. xo kas